Role of Small Business in Australia’s Economic Recovery

Australia faces its first recession in almost 30 years. All eyes are now turning to our employment figures.

Tax Reform as a stimulus for Domestic Business to Business commerce

The Morrison Government stated that it is open to fresh ideas for restarting the economy.

Small Businesses employ approximately 5 million people or 44% of the total Australian workforce (Source: ASBFEO ). Small Businesses are frequent innovators in growth industries and almost always investors in the local economy, hiring locally and purchasing from other Small Businesses. Clearly, Small Business has an important role to play in Australia’s economic recovery.

The bleak economic outlook has coincided with global supply chains being disrupted, triggering national interest in the supply of critical goods and services. Recent concerns over shortages in PPE saw Small Businesses respond first to the sure-up of domestic supply.

Incentives are in place to retain employees (Cash Flow Boost and Job Keeper), and to stimulate consumer demand in some sectors (eg. Home Builder Scheme).

I believe the important relationship between the Large Enterprise and Small Business warrants a closer look…After all, big business is the future for many small businesses – whether the small business grows into one, or becomes an essential business partner.

The Problem with recent Small Business Tax Reforms

Recent business tax reforms have centred on reducing company tax rates applicable to Small Business. Presently, a flat 27.5% applies to taxable income (down from 28.5% a few years ago).

Unfortunately, the marginal lowering of taxes will not in itself create jobs for existing Small Businesses. Here’s why: The ATO defines Small Business as a turnover of less than $10 million. Pre-tax net income for Small Business is on average 10.9% of turnover. A 1% decrease in tax rate for the largest small business would add just $10,900 to the bottom line (assuming 10.9% Net Profit Margin). 98% of Small Businesses have a turnover of less than $5 million and so the gains will generally be much less.

In short, a 1% to 4% tax rate reduction is unlikely to encourage many Small Businesses to add new staff to payroll, although it would assist profitability and cashflow.

Revenue Growth will be more important than Tax Cuts for Small Business.

Revenue growth is required to support the hiring of new staff. i.e New customers and additional sales of goods and services.

Large enterprises select suppliers based on criteria such as price, quality, speed, time certainty, complexity, flexibility, and risk. Australian businesses compete well in most areas, but with higher cost inputs, contracts are often lost on price. Small Businesses tend to be lean, operating on lower margins and less encumbered with overhead for the customer to manage. Consequently, the price differential between a large overseas supplier and a domestic Small Business supplier can be quite low in percentage terms.

The idea: What about a marginal tax incentive for Large Enterprises to purchase goods and services from domestic Small Businesses?

Proposed Mechanism: Pass an Imputed Tax Credit from Small Business to Large Enterprise for Goods and Services Delivered.

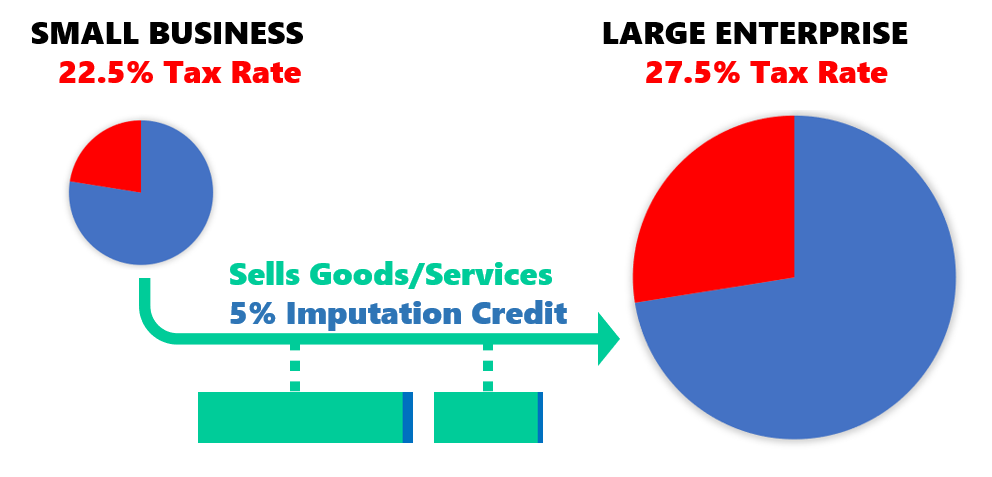

Let’s say that tax brackets for Small Businesses (turnover under $10 million) are lowered to 22.5% and Medium-to-Large Enterprise (turnover over $10 million) remain at 27.5% – leaving a 5% differential.

A 5% imputation tax credit could be passed by Small Business to Large Enterprises for goods and services procured. The tax credit would contribute to the bottom-line after-tax income of the Large Enterprise – making the procurement from Small Business more attractive to the Large Enterprise.

Tax incentives to Large Enterprises reduce federal tax revenue. However, the shortfall could be offset by increased state tax revenues (i.e Payroll tax paid by the Small Business on employees added to their payroll).

New Tax Reforms must include Dials and Levers for Future Challenges.

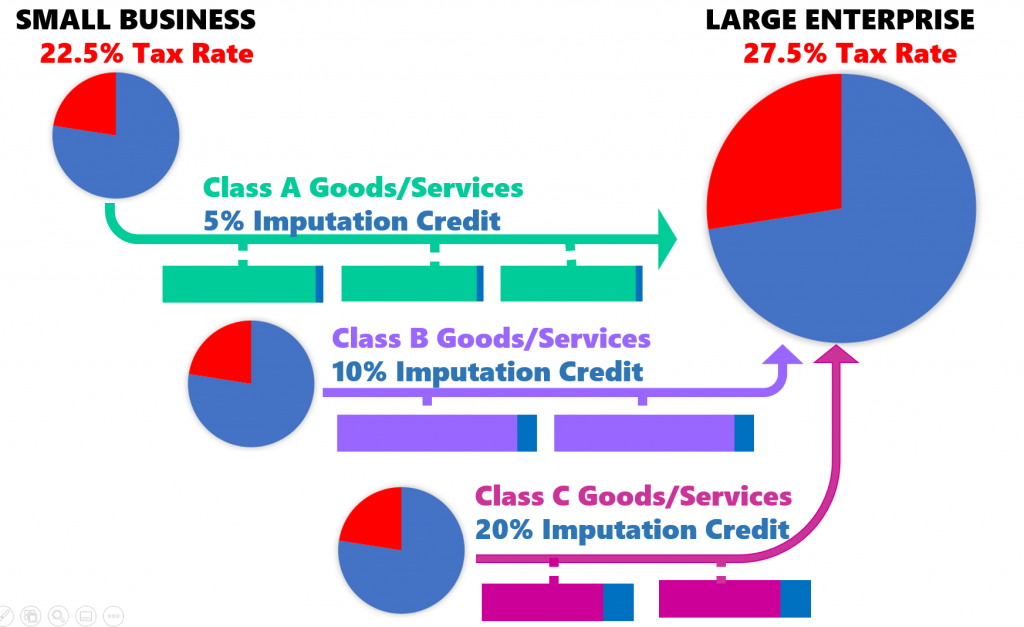

Imputed Tax Credits from Small Business to Large Enterprise could assist future policies and initiatives by supporting multiple classes. For example,

- Class A Imputation Credit (5%) for Goods and Services supplied to Large Enterprise

- Class B 2 X Imputation Credit (10%) for Goods and Services supplied to Large Enterprise that fit with Strategic Policies (e.g Company manufactures critical supplies, Workplace meets Equality criteria, Company belongs to an emerging growth industry)

- Class C 4 X Imputation Credit (20%) for Goods and Services supplied to Large Enterprise when temporary powerful stimulus is required.

Tax Reform should not add Complexity or Overhead to Business.

Implementation of this idea would not need to be complicated:

- Small Business applies in ATO Business Portal to issue Imputed Tax Credits.

- If approved, the Small Business would be entitled to include imputed tax credits in the footer of their Tax Invoice to Large Enterprise.

- Large Enterprise reduces Tax Payable by the Imputed Tax Credits received from Small Business.

Discussion

Not being an Economist, Policy Maker or a member of a Political Party…I’d love to know if this idea makes sense to others and of course if it breaks any fundamental economic rules / trade agreements.

Call out to those working professionally in procurement: Do you see many cases where a 5 % or 10% saving would swing a procurement decision?

How do others see Small Business assisting Australia’s economic recovery post-COVID19 pandemic?

Thanks for reading!